Share. LinkedIn. Facebook.

Twitter2Just like the amount of business opportunities available today has never been greater, so have the challenges of running your business successfully and profitably. Companies, despite their best efforts, sometimes end up taking the wrong decisions.

Not having a Board of Directors is one such mistake. I’d like to explain why I believe every company (all those not mandated by law) must have an engaged board and which type may serve the company’s best interests.Throughout my career I have been fortunate to work with some amazing entrepreneurs, business owners and CEOs, all of them head-strong individuals who knew exactly what they wanted to do.

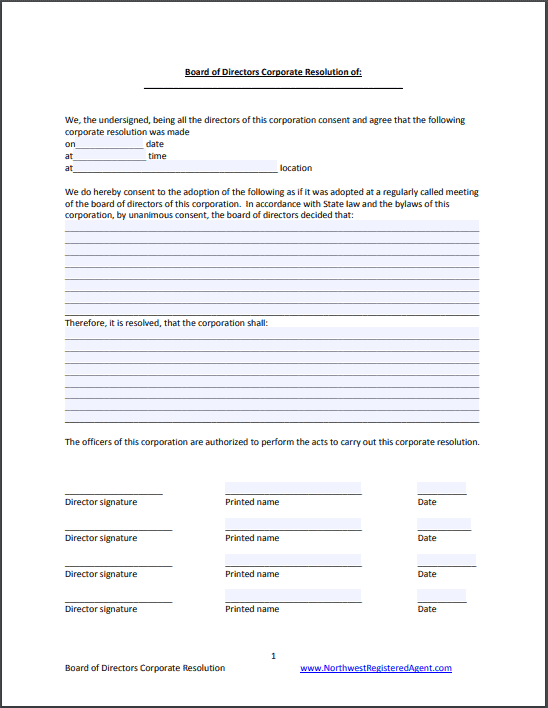

Fiduciary responsibility As noted above, corporate board members have a fiduciary responsibility to care for the finances and legal requirements of the corporation. They must act in good faith and with a reasonable degree of care, and they must not have any conflicts of interest.That is, the interests of the company must take precedence over personal interests of individual board members. Three Ways Directors can take Money out of a Limited Company. Salary, expenses and benefits – If you want the company to pay you a salary, expenses or benefits, you must register the company as an employer with HMRC.You must pay Income Tax and National Insurance contributions on any salary you receive, and pay the National Insurance contributions of your employees.

Your business may not have all the skills & expertise needed to operate effectively and continuously in an ever-changing environment. A Board of Directors (BOD) will help the senior leadership to step back from the daily operational grinds and focus strategically on its business.Board members (directors) that bring expertise from Strategy, Finance, Legal, Marketing, ICT and specialized industry / product related skills are almost always sought after. Other directors can bring along business contacts and networks, especially relevant for start-ups and high-growth companies. Boards also stand to gain when they have Gender, Demographic and Cultural Diversity.2. Corporate Governance.

'A company's Corporate Governance structure is critical for its successes. Think of Corporate Governance as a system of rules, principles and processes by which your company is directed and controlled. They are guidelines as to how your company can fulfill its goals to enhance value.Corporate Governance also provides a framework for balancing the expectations and interests of the many stakeholders in your company – which include your Shareholders, Board of Directors, Management, Employees, Customers, Suppliers, Financial Institutions, Government and the Community'. (Source: BoardTitans.com)3. Independence & Accountability. Boards are (or at least are expected to be) independent, act only in the interest of your company, free from conflicting interests that can compromise their judgment and be able to take a solid stand in the face of opposition.The Board of Directors has a dual mandate of Advisory and Oversight governed by their fiduciary / legal responsibilities.

They are collectively or in rare cases even individually accountable for your company’s performance, compliance and risk mitigation strategies.4. Strategic Direction. This is not a misplaced typo.

I firmly believe that Strategy is as much a responsibility of the Board as it is of your senior management and leadership. The level of involvement of the Board however may vary depending on the size of your company.Rather than just being a “rubber-stamp”, engaged Boards take a lead role in devising Corporate Strategies, ensuring that the company and all its departments are aligned towards its Strategic goals at the same time monitoring proper implementation and execution of these Strategic Plans.5. Bose wave serial number date of manufacture. Credibility & Legitimacy. An effective Board portrays integrity and availability of balanced objective advice which helps mitigating risk. Financial Institutions, Investors and partners view it favorably, which effectively lowers the cost of capital financing for your company.Customers, employees and vendors view it as a safeguard of their interests.

The ultimate protection of interests of various stakeholders of your company due to the existence of Boards further increases the Credibility of your company. This in turn can also be beneficial for owners / investors planning an exit strategy, make an Initial Public Offering (IPO), or further scale and grow the business. What kind of Board does your Company need? There basically two kinds of Boards and your choice should be driven by selecting the type that best suits your business requirements. An Advisory Board is a less formal association of individuals. The Board members do not have any fiduciary or legal responsibility towards the owners nor do they have any binding requirements for regular board meetings. The members have a genuine interest in the success of the company and its owner(s).

An Advisory Board primarily advises and gives feedback, but is almost never involved in the decision-making. Members mostly volunteer their time as mentors or in some instances may receive a small honorarium. This structure is best suited for early stage Entrepreneurs and small sized start ups. A Fully Mandated Board on the other hand has the ultimate power and holds fiduciary / legal responsibilities on behalf of your company.

/what-does-a-corporate-board-of-directors-do-398865_color1-5c890e0e46e0fb00017b31c9.png)

The board is fully accountable to its owners and shareholders. Fully mandated Boards conduct regular meetings and are heavily involved in the company’s decision-making processes. Board members for incorporated companies have a stringent compliance structure put in place by governing bodies from their respective countries. Fully mandated Boards are thus best suited for companies that want to bring in expert trusted advisors who will take decisions and be held responsible for the same.Although the majority of companies have any one of the above forms of Board, there are some that have both the Boards operating in tandem and complimenting each other. SummarizingLike all business decisions it is for your company to decide if it wants to invest its resources in having a Board of Directors and leverage this highly underutilized business tool.

Besides the many advantages we have seen, there is primarily one disadvantage wherein your company will waste its resources in a Board structure and composition if these are not aligned to your company’s requirements.A Strong and Effective Board of Directors is an invaluable asset, one that is a key to success in creating the wealth envisioned by the Entrepreneurs and Business Owners. What is your story?I am certainly interested in hearing about your experiences in forming and managing a Board of Directors for your company. Please share with us your learning, challenges and triumphs that you have experienced either working alongside or as a member of the Board yourself. LEAD WELL!ABOUT THE AUTHOR: is the CEO of BoardTitans – A Strategy and Corporate Governance Advisory firm. Besides having held various Board and C-level positions, he is passionate about working with Family Businesses and helping companies in Forming, Structuring and Reviewing their Board & Corporate Governance structures.